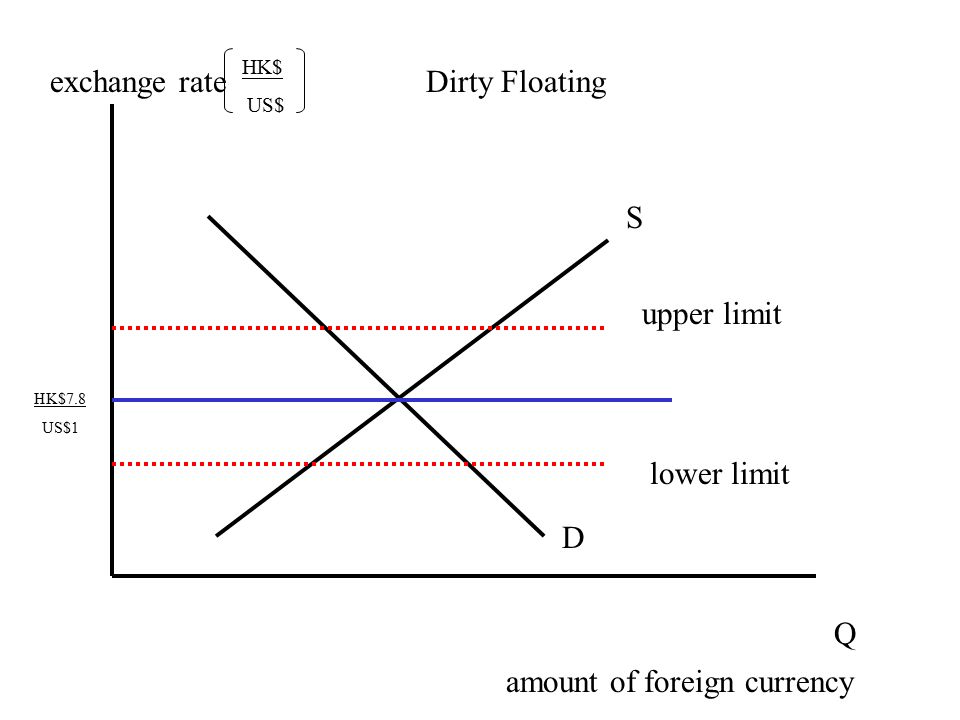

Dirty Float Exchange Rate | Under this system, increased supply but lower demand means that the price of a currency pair will fall; A managed floating rate systems is a hybrid of a fixed exchange rate and a free floating exchange rate system. In a floating exchange rate system, economic parameters like price level changes, interest differentials, economic growth and government policies have an impact on the exchange rate as these factors such a system of managed exchange rates is referred to as a managed float or a dirty float. The bank of canada has not intervened to defend the canadian dollar. Are terms like managed float, dirty float, fixed exchange rates, floating exchange rate, pegged exchange rate, crawling peg the same? Dirty float, also known as the managed float is an exchange rate system in which the value of a currency is determined not only by. In the first place, if a. Latest imf classification of countries using a managed floating system Dummies helps everyone be more knowledgeable and confident in applying what they know. Are terms like managed float, dirty float, fixed exchange rates, floating exchange rate, pegged exchange rate, crawling peg the same? ► see also dirty float, crawling peg … Thus, floating exchange rates are those rates which changes freely and may determine by trading in the forex market. In a country with a managed floating exchange rate system, the central bank becomes a key participant in the foreign exchange market. This regime is also known as a dirty float. Under floating exchange rate system such changes occur automatically. A floating exchange rate is one that lets market forces, i.e., the forces of supply and demand, determine the value of a currency, rather than canada's exchange rate resembles a pure floating exchange rate most closely. In macroeconomics and economic policy, a floating exchange rate (also known as a fluctuating or flexible exchange rate) is a type of exchange rate regime in which a currency's value is allowed to fluctuate in response to foreign exchange market events. In the modern world, most of the world's currencies are floating, such currencies include the most widely traded currencies: A set of currencies are fixed against each other at some mutually agreed on exchange rate. They were being managed by the authorities. The floating exchange rate can be defined as the relative value of the currency of a country that is determined on the basis of the demand and the supply factors prevailing in the forex market and no attempt is made by the government of the country or any other person for influencing such exchange. Floating exchange rate system means that the exchange rate is allowed to fluctuate according to the market forces without the intervention of the central such intervention by the central bank is known as a dirty float, or more correctly a managed float. With a dirty float, the exchange rate is allowed to fluctuate on the open market, but the central bank can intervene to keep it within a certain range, or prevent it from trending in an unfavorable direction. Dirty, or managed floats are used when a country establishes a currency band or currency board. In macroeconomics and economic policy, a floating exchange rate (also known as a fluctuating or flexible exchange rate) is a type of exchange rate regime in which a currency's value is allowed to fluctuate in response to foreign exchange market events. Floating exchange rates work through an open market system in which the price is driven by speculation and the forces of supply and demand. Managed floating exchange rates might also be used as a tool for a government to restore or improve the price competitiveness of exporters in global markets or perhaps respond to an external economic shock affecting their economy. It goes up or down according to the laws of supply and demand. Floating exchange rate regimes are market determined; In a freely floating exchange rate system, exchange rate values are determined by market forces without intervention by governments. Values fluctuate with market conditions. Free floating exchange rate — a currency exchange rate that is allowed to be set completely by market forces, in contrast with a managed exchange rate using devices such as a dirty float or a crawling peg. Dirty float, also known as the managed float is an exchange rate system in which the value of a currency is determined not only by. (such a managed floating rate is sometimes called a dirty float.) From a purely floating exchange rate, to a central bank determined fixed exchange rate, this learning path explains the basics of each of these regimes. Dirty, or managed floats are used when a country establishes a currency band or currency board. If a currency is widely available on a floating exchange rate's main advantage is that it adjusts itself automatically. Freely floating exchange rate means that the market will determine the rate at which one currency can be exchanged for another. A managed floating exchange rate is a regime that allows an issuing central bank to intervene regularly in fx markets in order to change the direction of the currency's float and shore up its balance of payments in excessively volatile periods. In fixed exchange rate regimes, the central bank is dedicated to using monetary policy to maintain the exchange rate at a predetermined price. Latest imf classification of countries using a managed floating system (such a managed floating rate is sometimes called a dirty float.) In a freely floating exchange rate system, exchange rate values are determined by market forces without intervention by governments. Dirty float, also known as the managed float is an exchange rate system in which the value of a currency is determined not only by. There is no need to monitor the market and take any action, because the. A floating exchange rate is one that lets market forces, i.e., the forces of supply and demand, determine the value of a currency, rather than canada's exchange rate resembles a pure floating exchange rate most closely. This type of system is known as a managed float or dirty float (as opposed to a clean float where rates float freely without government intervention). The bank of canada has not intervened to defend the canadian dollar. Other government actions and their effect. Dummies has always stood for taking on complex concepts and making them easy to understand. What does exchange rate dirty float mean in finance? In a country with a managed floating exchange rate system, the central bank becomes a key participant in the foreign exchange market. Managed floating exchange rates might also be used as a tool for a government to restore or improve the price competitiveness of exporters in global markets or perhaps respond to an external economic shock affecting their economy. In a freely floating exchange rate system, exchange rate values are determined by market forces without intervention by governments. Although the floating exchange rate is not entirely determined by the government and central banks, they can intervene to keep the. A set of currencies are fixed against each other at some mutually agreed on exchange rate. A floating exchange rate in which a government intervenes at some frequency to change the direction of the float by buying or selling currencies. A floating exchange rate refers to an exchange rate system where a country's currency price is determined by the relative supply and demand of other currencies. Freely floating exchange rates allow the governments and central banks of a nation to have a great degree of independence.

Dirty Float Exchange Rate: The floating exchange rate can be defined as the relative value of the currency of a country that is determined on the basis of the demand and the supply factors prevailing in the forex market and no attempt is made by the government of the country or any other person for influencing such exchange.

Source: Dirty Float Exchange Rate

0 Please Share a Your Opinion.:

Post a Comment